Every few months, when I’m at market research conference, someone in the industry pulls me aside and says some version of the same thing:

“Conversational research sounds cool — but it’s really only good for quick, simple stuff… right?”

And honestly? It makes me want to gently bang my head on our booth.

Because this myth — that mobile-first, conversational approaches are lightweight, surface-level, or only suited for tactical feedback — is one of the most persistent misunderstandings in insights today. And it’s holding teams back from getting deeper, faster, more human insights.

Let’s set the record straight.

Somewhere along the way, “conversational” became confused with “informal” or “unsophisticated.” As if using natural language and engaging formats somehow lowers the quality of the methodology.

But here’s the reality: conversational research is not about being fun. It’s about being effective. It’s about using real dialogue to reduce cognitive burden on participants in a way that increases engagement and produces more meaningful insights.

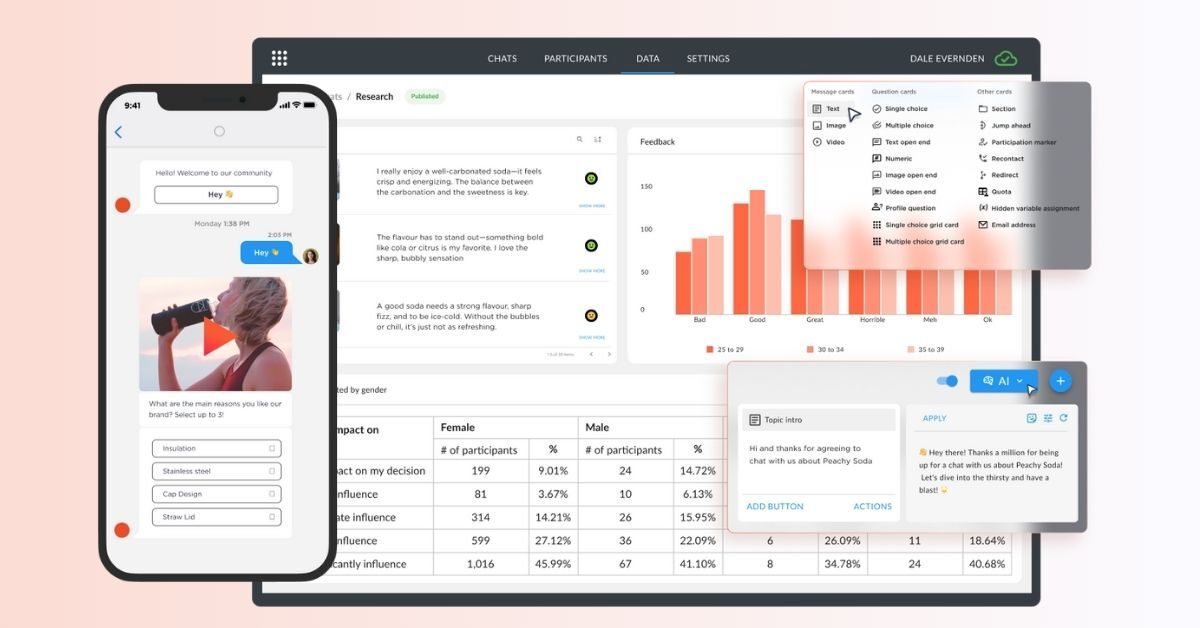

And the Rival Technologies platform was purpose-built to support rigorous, enterprise-grade research — not just quick pulses or one-off intercepts (although we can facilitate those too).

While it’s simple to use, Rival’s capabilities are sophisticated, scalable, and built for enterprise complexity.

Conversational approaches aren’t limited to quick “gut check” studies or brand sentiment pulses. Rival is designed specifically for iterative, ongoing insight generation — the type of research that used to require heavy community infrastructure and complicated tool stacks.

For example:

And because chats are engaging, you get higher throughput:

Conversational research is flexible. It can be used across it’s agile and longitudinal studies for insight-rich results.

One of the biggest misconceptions is that conversational research somehow sacrifices quant rigor.

In reality, Rival gives you:

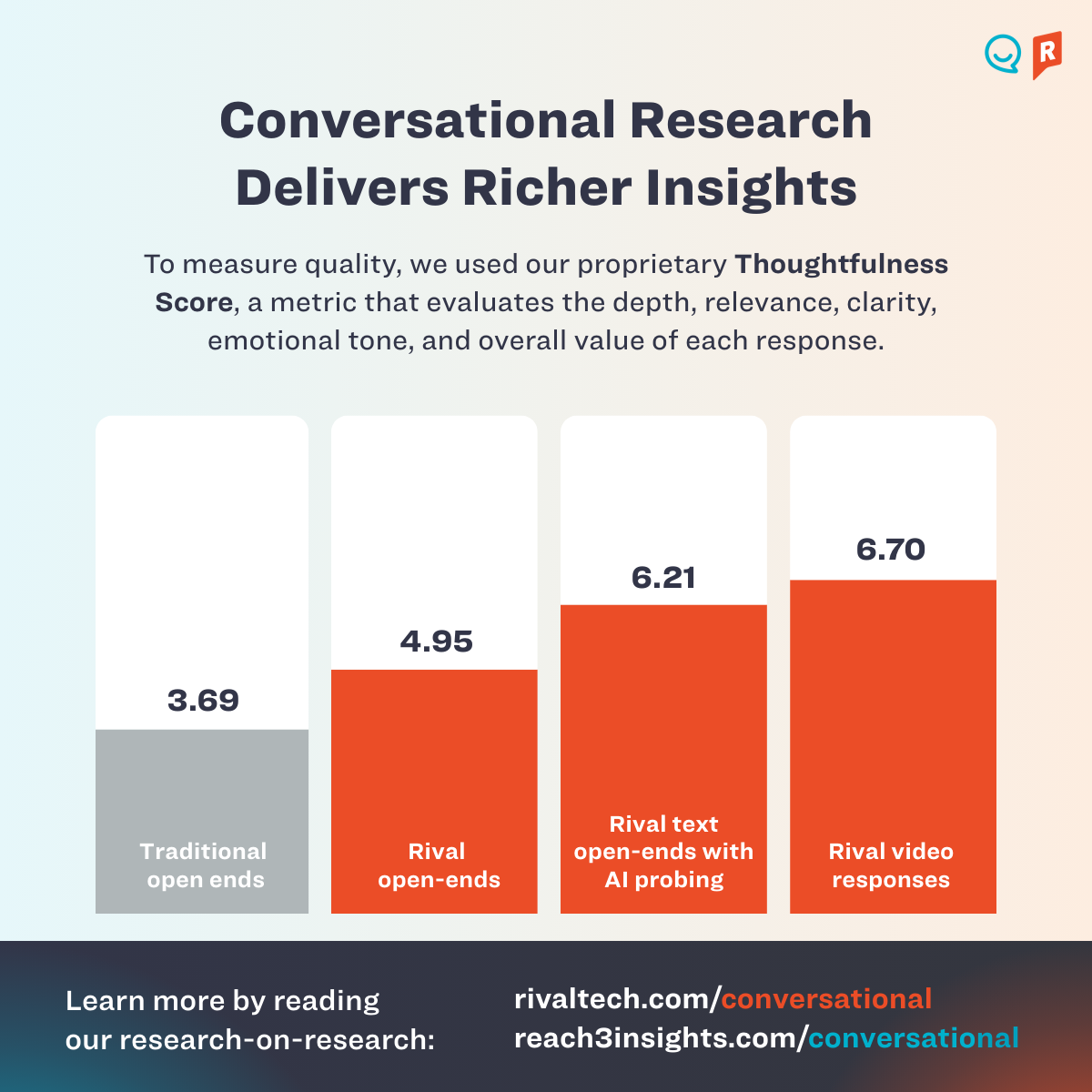

Our most recent research-on-research shows that conversational delivers up to 8x deeper insights than traditional research.

This means you don’t just get depth — you get depth at scale.

Many popular market research platforms treat every participant the same. The result: people get irrelevant surveys, which results in at best irrelevant or at worst fraudulent responses.

Rival does the opposite — it treats every participant like a unique individual.

This unlocks use cases far beyond simple surveys, like:

Rival delivers sophisticated, enterprise-level research n a way people actually want to participate in.

One reason teams assume conversational = consumer research only is because they associate it with “Gen Z” or pop culture use cases. While in fact, people of all ages (including Boomers) prefer conversational methods over traditional research.

Conversational research can be used whenever human insights are needed. After all, in B2B research, you are still engaging with people. We’re seeing a growing number of B2B insight communities on the Rival platform.

Rival is used in categories where rigor, privacy, and security matter more than anywhere else:

Why? Because conversational research solves one of the biggest challenges in these industries: participant fatigue.

When research feels like a natural chat — not a test — completion rates soar, and data quality follows.

Many brands across various industries use conversational research for complex, high-stakes work:

CashApp, a leading fintech company, runs multi-country insight communities to guide product innovation, messaging and more

Respected brands like Warner Bros. Discovery use conversational surveys and video feedback to inform creative development

CPG teams run iterative concept testing at weekly cadences

Working with our sister company Reach3 Insights, healthcare orgs use conversational surveys to capture in-the-moment feedback from healthcare professionals and care givers

And these aren’t “lightweight” studies — they’re the type of initiatives that previously required big budgets, long timelines, and teams of analysts.

Conversational research didn’t simplify the methodology — it simplified the experience. The rigor remains.

So why does this myth persist?

Honestly? Because the industry has equated “rigor” with “formal.”

With big grids.

With academic language.

With 20-minute surveys and desktop-only UX.

But rigor doesn’t come from complexity. It comes from clarity, engagement, and better, more thoughtful responses.

And that’s exactly what conversational research delivers.

Subscribe to our blog to receive the latest news, trends and best practices from market research experts.

No Comments Yet

Let us know what you think