Do you need real-time insights on how consumer behaviors are changing? Looking to have ongoing conversations with your customers at scale? Want to reduce research costs and quickly expand your programs? If you answered yes to any of these, a research community may be for you.

One of the most enduring and popular tools in the insights industry, research communities are incredibly reliable – and thanks to mobile technology and innovations like AI, they’re also more powerful than ever.

In fact, Greenbook found that communities remain one of the most widely used insight-gathering methods for research buyers. These modern insight communities have evolved far beyond the old online forums of years past. They leverage real-time, mobile-friendly engagement and even AI enhancements to deliver faster, high-quality insights at scale.

According to Esomar, communities provide many benefits to brands: agility, convenience and technical and geographic versatility.

Looking to understand the world of research communities? Here’s an overview of what they are and how they work, along with some best practices to keep in mind.

In the context of market research and consumer insights, research communities are groups of individuals who participate in ongoing research studies related to a specific topic, product, service, or brand. By fostering continuous, real-time connections, these communities enable brands to build trust, drive loyalty, and uncover actionable insights from their target audience.

Research communities are sometimes also called “consumer panels,” “market research panels,” "market research online communities," “insight communities,” or simply “communities.” Regardless of the label, the core idea is the same: a dedicated group of people who opt in to give feedback on an ongoing basis, rather than just one-off survey participation.

From our point of view, three things are critical for a true research community:

A shared mission: Members understand why they joined the community and how their feedback and insights will be used. While some communities are "blind" (that is, community members don't know the brand running it), the community has a clearly communicated purpose or mission that everyone rallies around, creating a sense of joint commitment. This transparency and purpose-driven approach builds trust and engagement among participants.

.png?width=2171&height=1316&name=ReContact%20(1).png)

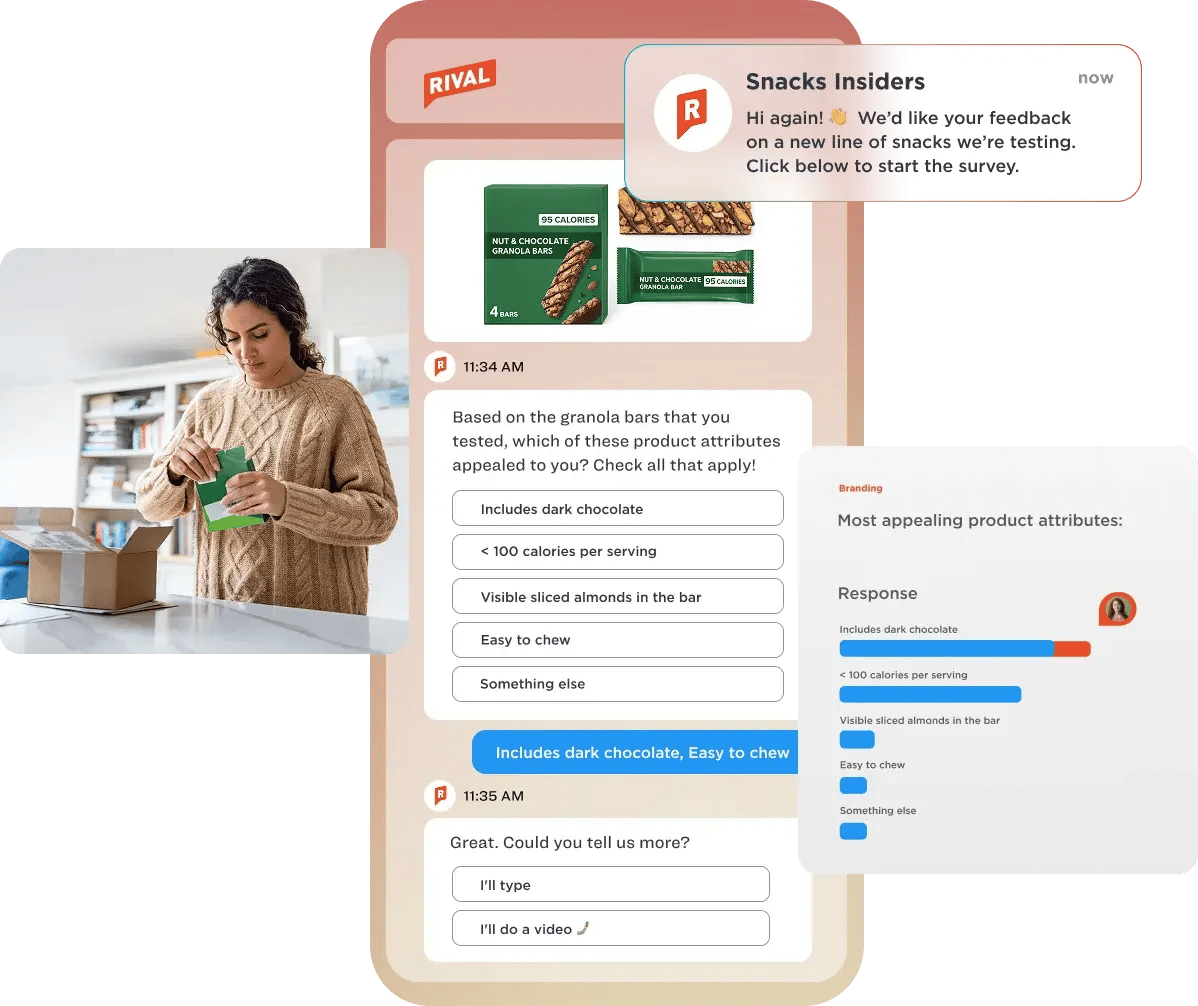

Permission to re-engage: Unlike ad-hoc surveys, a community comes with permission to re-contact participants, often through convenient channels. Increasingly, this re-contact happens via SMS and mobile notifications (instead of just email) to facilitate in-the-moment research and quick response times. Essentially, members have said “yes, you can keep the conversation going,” which is fundamental to the ongoing nature of a community.

Longitudinal learning: A good research community platform remembers what you already know about your members and builds on that knowledge over time. This means you can accumulate data about each member’s opinions and experiences. Over time, the community becomes more valuable as profiles of members grow richer and more intricate. Each new activity can leverage what you’ve learned before.

By ensuring a shared mission, re-engagement consent, and longitudinal learning, a research community truly functions as a community rather than just a one-time study. Members feel invested in the process, know their voices matter, and researchers can continuously build deeper insights.

How do I build a research community?

There are various ways to recruit members for a research community. The right approach will depend on your brand, your research objectives, and the types of people you want to engage.

From a community management perspective, we recommend using a mix of sources when recruiting. These include:

Using both traditional sources and creative new methods increases your chances of including a wide range of voices.

Rival’s customer success team has seen that a multi-channel strategy tends to bring more diversity into your research community. While panel providers and river sampling are reliable and predictable, relying only on those can lead to an over-concentration of “professional survey takers” who sign up mainly for incentives.

👉 For a deeper dive into the pros and cons of different channels, check out our guide on community recruitment – it breaks down various sources and how to optimize each.)

Basically, for everything and anything. 🙃

That’s a bit of an exaggeration, but the reality is that if you’re using a robust research community platform, there are a lot of potential use cases. And contrary to what some may believe, research communities are not just for exploratory or qualitative studies. In fact, today’s best-in-class communities leverage the full power of mobile tech to capture quantitative data at scale and rich qualitative feedback (including video responses).

Here are some top use cases for research communities:

Understanding customer needs and preferences: Continuously take the pulse of your customers’ evolving needs, preferences, and behaviors. This ongoing insight helps you improve product design, refine marketing strategies, and enhance customer experiences based on what people truly want or expect at any given time.

Product innovation and pipeline development: Get feedback on new product ideas or feature concepts before they launch. With a community, you can quickly test concepts or conduct IHUTs – identifying potential issues and areas for improvement early in the development cycle, well ahead of a full market release.

Content and messaging refinement: Test marketing messages, advertisements, or content ideas with your community members. This allows you to see which messages resonate or which creative concepts hit the mark. You can then confidently roll out campaigns that you know will connect with your broader target audience.

Customer journey mapping: Understand the customer journey in depth – including pain points, challenges, and moments of delight. For example, you can recruit some people from your research community to participate in mobile missions and share their real-time experience with you through a series of mobile diaries. Research initiatives like this can illuminate each step of their experience (from initial awareness to purchase to post-purchase), helping you pinpoint opportunities for improvement in processes or touchpoints.

These are among the most common applications of a research community. Of course, there are circumstances when insights communities may not be the best solution, but in general, they are a good solution for longitudinal learning and engaging a pre-recruited group of people.

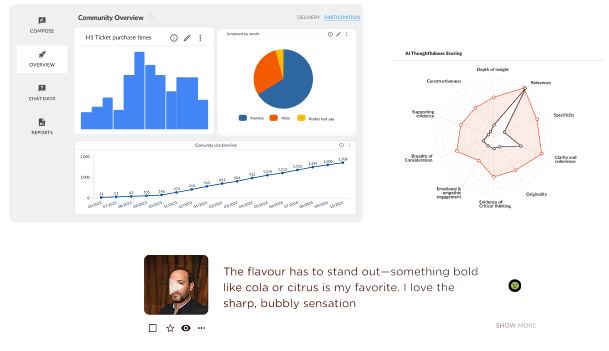

No – modern research communities can blend quantitative and qualitative research seamlessly. In fact, one of the biggest misconceptions is that communities are only useful for focus groups or open-ended feedback. The truth is, a well-run community can capture survey data from hundreds or thousands of members and facilitate rich qualitative exercises, all in one platform.

Many research communities today even incorporate video feedback. For example, you might ask community members to record short video testimonials about a product experience, or use a mobile diary study to gather in-the-moment reactions over a week. Top insight community platforms make it easy to integrate these different formats. They’ll blend quantitative surveys, qualitative questions, and multimedia tasks into one cohesive, conversational experience for participants.

In other words, a research community isn’t limited to one type of research – it’s a flexible environment where you can run a wide variety of projects. For example, you can use your community to facilitate:

This is just scratching the surface. Research communities are incredibly flexible and can handle an extensive array of research needs. Essentially, any research activity that would benefit from engaged, repeat participants can likely be done through a community. A well-designed community platform supports both the “what” (quantitative) and the “why” (qualitative). It gives you the best of both worlds in one place.

Do I *really* need a research community?

We’re a bit biased, but we think a research community is a must-have for any sophisticated insights program.

It provides a level of agility and depth that is hard to replicate with other approaches. With a community, you don’t have to go out and find a new sample (or hire a panel vendor) every time you launch a study – you have ongoing access to a group of people who have already opted in to share their feedback. This means when a new research question arises, you can get answers in days or even hours, not weeks.

If you’ve decided to invest in a research community, the next big question is which platform or vendor to partner with. There are many research community providers in the market today (from full-service firms to DIY / self-serve software platforms). The best platforms are the ones that enable you to do the following:

Today, a mobile-first approach is key. Your community platform should make it easy to reach members on their phones – for example, sending SMS or in-app notifications to alert members of new activities. Don’t settle for a solution that only sends long email surveys; look for one that excels at mobile engagement (mobile-first conversational surveys are better than traditional questionnaires).

The platform (and the team behind it) should support diverse recruitment methods. This means you can integrate with your CRM, run social media invites, use referral links or QR codes at events, and tap traditional panels – all feeding into your community.

Authoring surveys should be flexible and powerful – you’ll want features like question randomization, piping/branching, masking, and support for all common question types (single/multi-select, scales, open-ends, etc.). At the same time, the platform should enable conversational research – activities that feel more like a chat than a formal survey. Research-on-research shows that this approach delivers:

✅ Better participant experience across all generations — from Gen Zs to Boomers

✅ Up to 8x richer content compared to traditional surveys

✅ More thoughtful responses — meaning, higher quality data

The ideal market research platform allows you to capture more than just text responses. The ability to collect video feedback (and ideally, images or audio clips) from community members is increasingly important. Likewise, the platform should let you embed video or other media into your questions (for instance, show an ad video and then ask for reactions).

Modern insight communities rely on these richer inputs. This kind of multimedia capability makes your research more engaging for participants and more insightful for your team.

Leading community platforms are starting to integrate AI tools to streamline community management and analysis. This can include AI-powered probing (to get deeper insights from your community members and agentic AI for analysis and storytelling.

Over time, your platform should build rich profiles of each member and allow you to use that information. Look for the ability to tie past data to current surveys and customize questions or send-outs accordingly. In practice, this means the platform can “remember” each participant’s previous answers and characteristics, and you can segment or personalize research activities.

No one wants to get a random survey at 10 pm at night.

So, choose an insight community platform that lets you send the right activities to the right subset of community members at the optimal time. This could involve smart distribution tools or audience segmentation features. Essentially, you don’t want to blast every survey to all members; you want to target by relevant criteria (e.g., send a product feedback survey to people who purchased that product, send a regional question to people in that region, etc.) and schedule or automate those sends for optimal engagement.

Data security and respondent privacy are paramount. Ensure any platform you consider has robust security practices and relevant compliance certifications. For instance, if you’re in health care or collecting health-related data, the platform should be HIPAA compliant. Likewise, compliance with GDPR (for European participants) and other data protection regulations is non-negotiable.

The vendor should be transparent about how data is stored, used, and safeguarded. Always ask about their privacy policy and security audits – a reputable provider will have clear answers here.

Consider what service model fits your team. Do you need a DIY platform where your team designs and deploys all research? Or would you benefit from assisted services like having experts to help with community management, survey programming, or analysis? Some vendors even offer full-service consulting (for example, our sister company Reach3 Insights provides full-service support to maximize community value).

The key is to find a partner that offers a spectrum of services and is willing to flex to your needs.

Finally, and perhaps most importantly, we recommend picking a market research platform or firm that will treat you like a partner in the management of your community. Building a successful community is a long-term play, and it helps immensely to have a vendor who actively collaborates with you on strategy and best practices.

In fact, ESOMAR’s latest industry report notes that since nearly half of research projects are now conducted internally by client teams, the relationship between client-side researchers and external providers should shift to a “partner-to-partner” model rather than a simple vendor transaction. In other words, your community technology provider or services firm should feel like an extension of your team, invested in your success.

When evaluating options, pay attention not just to the platform features, but also to the people and expertise behind the platform. Ask yourself: will they help me succeed? Do they understand our industry and audiences? Will they be responsive and consultative?

Choosing the right platform comes down to finding the mix of capabilities and support that fits your organization. Do your due diligence: take demos, ask for case studies, and even request references.

The good news is that with the robust platforms available today (and continuous innovation from leading providers – for example, Rival’s insight community solution combines mobile, conversational surveys with integrated qual/quant and AI-powered engagement), you’re likely to find a solution that can check all the boxes.

At a time when companies need to understand evolving consumer preferences, research communities can play a huge role in capturing first-party data that market research teams can turn into actionable insights.

The key to maximizing the value of this tool is recruiting the right people, optimizing the community experience, and using the right platform that facilitates iterative, agile research.

If you’d like to learn more or want to see Rival's insight community solution, feel free to request a demo of our platform. 👋

Last updated: February 10, 2026

Subscribe to our blog to receive new insights on market research trends.

No Comments Yet

Let us know what you think