Market research is having a moment — and honestly, it’s about time. The global insights economy just crossed $150B USD, according to Esomar, and research software alone surged 11.5% year over year, topping $62B USD. That’s great news for an industry that, for decades, has struggled to shake the reputation of being slow, rigid, and overly academic. 2026's market research trends highlight this momentum.

But here’s the twist: while the tools are accelerating at breakneck speed, consumers are craving more humanity — more emotion, more authenticity, more real understanding.

But here’s the twist: while the tools are accelerating at breakneck speed, consumers are craving more humanity — more emotion, more authenticity, more real understanding.

So what does “great research” look like when AI is everywhere and attention is scarce?

This article breaks down the seven biggest trends from our new Market Research Trends 2026 report — and if you want the full deep dive, you can download the complete report here.

Let’s get into it.

1. AI

2. Implicit research

3. The return of the classics (segmentation, journey mapping and more)

4. The debate on synthetic respondents

6. The new definition of data quality

7. More focus on learning and experimentation

AI isn’t a headline anymore — it’s a daily workflow. According to Greenbook’s 2025 GRIT report, high-performing insight suppliers now automate an average of 5.1 project functions using AI.

As part of the 2026 Market Research Trends report, we surveyed insight professionals using our conversational research platform. In this study, researchers indicated that AI and agents are already becoming part of their day-to-day lives:

62% say “most” or “some” of their team is already using AI

64% say the number of AI tools they use increased over the past year

71% believe AI will improve their jobs

90% are excited about AI-assisted analysis

Researchers are using AI for analysis, transcription, theme clustering, storytelling support, and even early-stage strategic thinking. As Teresa Correa-Pavlat from Haleon says in The Next Era of Insights Report, AI helps insights teams “connect the dots across a wider set of data” and stretch curiosity further.

But the vibe isn’t blind enthusiasm — it’s cautious optimism. People want AI to handle the heavy lifting so that humans can focus on what machines still can’t do well: interpretation, creativity, and empathy.

Bottom line: AI is now infrastructure. Not the star of the show — but the engine that makes the work faster and sharper.

AI has brought back the DIY culture. Anyone can go from an idea to a proof of concept in a matter of hours or days, with little risk. If there was ever a time to design and build the products of the future, it is now. AI is the collaborator that makes it possible.

- Graeme Ford, Founder & Innovation Consultant, PunkMRX

Researchers know it well: people don’t always say what they think. Or think what they say.

That’s why implicit research has emerged as a key market research trend. With emotions and polarization shaping so many choices, teams are turning to methods that dig below surface-level answers.

What we’re talking about here isn’t necessarily about abandoning questions, but instead it’s about asking in smarter, more intuitive ways.

At Reach3 Insights, a methodology called emotional elicitation demonstrates how to bring System 1 and System 2 thinking together in practice using the Rival plaform. Instead of asking consumers directly how they feel, participants are first shown a curated set of images that might capture their emotional response. Only then are they asked why they chose a specific image.

To understand what people actually think, feel and do, we need to go beyond traditional research approaches. In 2026, we’ll see faster adoption of AIaccelerated, mobile techniques. By delivering immersive and immediate feedback, these conversational approaches help reveal the underlying dynamics driving decision-making.

-Matt Kleinschmit, CEO and Founder, Reach3 Insights

In fashion, what’s old is new again—cargo pants, wide-legged jeans, even low-rise denim are making a comeback. The same thing is happening in research.

Methods like segmentation, ethnography, and path-to-purchase studies never really went away. But in 2026, they’re back in style—refreshed by mobile-first tools, AI-accelerated techniques, and faster, more flexible workflows.

Segmentation has always been about making sense of the messy reality of consumers. The difference now? Teams are doing it faster, lighter, and more often.

Enter the rise of the “mini-segmentation.” These smaller, focused projects give researchers a quick, actionable read on audience needs and attitudes, without waiting months for a full rebuild. A light factor pass here, a quick profiling exercise there, and suddenly teams have a current picture of who matters most before jumping into message testing or value-prop development.

As Leigh Admirand, Executive Vice President at Reach3 Insights, wrote in her American Marketing Association piece: “Segmentation today isn’t about sorting people into neat little boxes. It’s about truly understanding what makes them tick—and being able to adapt when things shift.”

Modern segmentation blends conversational inputs, open-ended responses, and even video, so AI can handle the heavy lifting while researchers focus on what really counts: interpretation and direction.

Ethnography is also getting a glow-up. What used to require flights, transcripts, and long observation cycles now happens in real time.

Mobile-first insight communities and video diaries let researchers capture context as life happens: where people shop, scroll, or snack. Instead of waiting for fieldwork to wrap, teams can review video feedback on the fly, spot emerging patterns, and follow up while the moment is still fresh.

AI lends a hand by handling transcription and pattern detection, freeing researchers to focus on what really matters: the human story.

Rethinking journey mapping is a MUST DO for companies. As AI becomes a part of everything, and Search fades away, what are the channels, info sources and decision-making pathways? Brands need to know and that will be critical.

-Chi Paler, Head of Customer Insights, 10x Genomics

Synthetic respondents are one of the most talked-about (and divisive) innovations in research right now. And this showed up in our own research: 43% of researchers said they are "not excited" about the use of synthetic respondents in the insights industry.

Supporters see synthetic data as a way to move faster, test early ideas, and fill in gaps before fieldwork begins. The Market Research Society’s Delphi Group even called it “a useful addition to the toolkit.”

And there’s reason for optimism. A Colgate-Palmolive and PyMC Labs study found that large language models could replicate human purchase intent with up to 90% of real test-retest reliability. When designed carefully, AI-generated respondents can produce surprisingly realistic patterns across demographics. In the right context, synthetic data can reflect real behavior—not replace it, but complement it.

Still, it’s important to recognize what’s at stake.

In an article for Marketing Week, Jane Frost CBE, Chief Executive of the Market Research Society, says the potential for big mistakes from decisions driven by synthetic respondents is still significant.

“While undoubtedly being cheaper in the short term, using synthetic data as the sole basis for marketing campaigns is fraught with long-term reputational and financial risk,” she explains. “In an age when marketers are increasingly being asked to do more with less, the potential for an entire campaign to misfire on this basis is something they can ill afford.”

The rise of synthetic data won’t kill primary research.

Let’s get one thing clear though: The rise of synthetic data won’t kill primary research. If anything, it highlights why human engagement matters more than ever.

“AI needs to be regularly refreshed with primary research, or the data becomes outdated, out of context and polluted by the biases and problems with historic information,” Frost continues. “Without engaging real people, you simply can’t predict with any certainty how they will react to your content.”

I believe synthetic data has its use and applications. But leveraging synthetic data to create artificial respondents to ‘boost’ the sample is likely a weaker application.

Just because the algorithm is clever enough to create synthetic responses of real humans doesn’t mean it can help uncover deeper insights. You might be better off working with the sample limitations, leveraging insights qualitatively, instead of pretending you have a robust sample to interrogate deeper.

- Pavi Gupta, VP of Insights & Analytics, Chobani

Despite all the buzz around AI and synthetic data, one truth remains: connection with real people still matters most.

In a world where algorithms can predict behavior but not emotion, smart insight leaders are leaning on the power of genuine human connection to understand customers.

“Community has been a lifeline for us in the last year,” Mary Anne Fitzgerald, Director of Consumer Insights at Balsam Brands, shared in a recent webinar. “It was so joyful to hear how connected our community members feel to us.”

When participants feel heard, they open up. They share more freely. Insights get deeper and more nuanced. Feedback stops feeling like a task and starts feeling like collaboration.

There’s another benefit: when you’re talking to your own consumers (for example through a branded insight community), the data itself becomes more reliable. It’s harder for data fraud or fatigue to sneak in when there’s a real relationship behind the responses.

For Rival, Reach3 and Angus Reid Group clients, we’ve seen this model work across industries where community members aren’t just respondents but ongoing partners in shaping strategy and creativity. Each share-back, thank-you video, or quick follow-up poll builds momentum and mutual trust.

I’m really drawn to participatory and community-driven research. There’s a shift happening where people don’t just want to be “subjects”, they want to co-create the solutions. I’m also excited about how insights are being tied to social impact i.e using data to drive change, not just decisions.

- Stella Igweamaka, Senior Consultant, New Markets & Opportunities, Servus Credit Union

At a time when brands need insights fast, data quality is more critical. And in 2026, quality is more than just about fraud detection.

It’s not just about catching bots or screening out fraudulent actors. It’s about protecting the integrity of insights from start to finish: how people are recruited, how questions are asked, and how responses are interpreted.

The Global Data Quality Project, a collaboration among leading industry associations, is taking that broader view. Their work spans supplier transparency, sampling practices, fraud prevention, respondent experience, and even participant education. The mission is simple: rebuild trust in research by creating standards that protect both people and data.

As Jennifer Reid, Co-CEO and Chief Methodologist at Rival Group, wrote in Greenbook: “Even after the fraud is filtered out, the biggest threat to data quality is not always fake respondents. It’s real ones who are bored, fatigued, or simply not engaged.”

That’s the crux of the issue. Good data relies both on clean samples and motivated participants who feel seen and valued. When engagement drops, even real responses lose meaning.

Esomar’s latest report echoes this shift, identifying “respondent trust and inclusion” as an emerging differentiator for research firms. Similarly, GRIT’s 2025 report lists data quality and integrity among the top five priorities for tech providers and fieldwork partners.

Communities are becoming a vital part of the data quality solution. They give researchers a direct line to verified participants and create an environment where people are invested in sharing authentic feedback.

As Sophia Gomez Garcia of Warner Bros. Discovery explained:

“We run a community called the Warner Brothers A List community, and it’s very valuable for our organization, both in terms of efficiencies and cost savings. The community has never been more important in our organization because as we continue to do so much quant, we see an uptick in sample fraud, and it’s become harder for panel providers to separate bots.

When you have a community like ours, the incentive is different, and there is a much lower risk of that type of infiltration or fraud.”

That level of control makes all the difference. When brands build and manage their own communities, they know exactly who they’re hearing from. They can validate participants through photos, videos, and consistent engagement, creating the trust and accountability that true data quality depends on.

SMS and WhatsApp distribution adds an extra layer of protection. While it’s easy to create multiple email addresses, the same is not true for securing multiple phone numbers. Mobile-first distribution makes it much harder for bots, click farms and fraudsters to game your research for incentives.

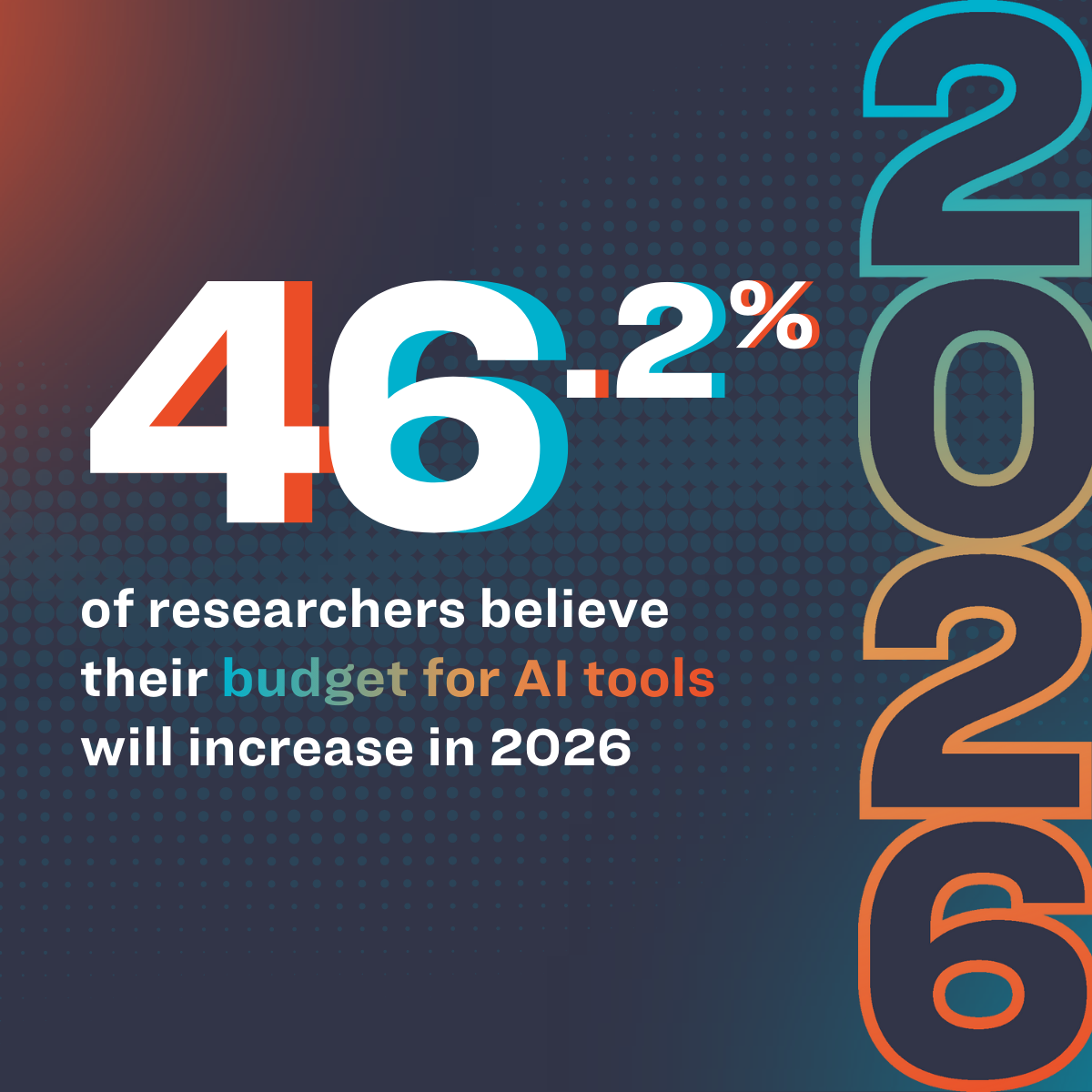

The best insight teams in 2026 and beyond will be the ones that never stop learning. This includes investing in AI tools and agents to improve quality and productivity. Our research indicates that 46% of researchers expect their budget for AI to increase in 2026.

According to GRIT’s 2025 Insights Practice Report, “organizational experimentation” is now a defining trait of high-performing insight functions. These teams see testing as part of the process, not a side project.

Experimentation doesn’t have to mean big, risky pilots. For some, it may mean trying “vibe coding” or creating their own custom GPTs. For others, it may mean running a conversational research study alongside a traditional survey, or trying an AI agent for a specific task.

From hype to hands-on

At Rival, we’ve taken this mindset to heart through our Innovation Insiders program, a year-long cohort that helps brand-side researchers learn, test, and operationalize AI in real-world projects. Participants explore use cases, run pilots, and share what works (and what doesn’t) in a safe, collaborative environment.

This approach turns curiosity into capability. It replaces hype with hands-on learning and helps teams future-proof how they work.

The truth is, experimentation does take extra work. You’re probably going to have to carve out time you don’t really have...But it’s worth it. This mindset of staying curious, running little experiments, not gripping the wheel too tight is how you get to the big stuff: operational efficiencies, new ways to serve customers, smarter ways to sell.

-Andrew Reid, CEO and Founder, Rival Technologies

If there’s a single thread running through all these market research trends, it’s this: the future of insights isn’t about choosing between technology and humanity. It’s about combining them.

AI is changing how we collect, analyze, and share information. But the researchers leading the way aren’t just adopting new tools—they’re redefining what better looks like. Faster doesn’t have to mean shallower. Automation doesn’t have to mean less human.

The most exciting progress is happening where curiosity, creativity and technology intersect.

GRIT calls this a “make or break” moment for the industry: a time when agility and foresight separate innovators from imitators. At Rival, Reach3 and Angus Reid Group, we see that every day. Technology might be the engine driving insights forward, but humanity is still the steering wheel.

Our mission remains the same: to help researchers ask better questions, listen more deeply, and turn every interaction into insight.

The more AI rolls out, the more obvious it is that research skills are a core competence for the AI era. It's just that the jobs will be different.

- Mike Stevens, Founder, Insight Platforms

If 2025 was the year of experimentation, 2026 will be the year of integration—where the tools, the teams, and the talent come together to create insights that are not only faster, but more meaningful.

Learn 7 ways insight teams are redefining quality, connection and impact in the age of AI. Get your copy of Market Research Trends 2026.

Note: A version of this article was first published in January 2021. We update this every year with fresh market research trends and predictions.

Subscribe to our blog to receive new insights on market research trends.

No Comments Yet

Let us know what you think