Last week, the Reach3 Insights and Rival Tech team was in Dallas, Texas for The Quirk’s Event. The two-day conference featured amazing presentations as well as networking.

I came back from the conference feeling recharged and excited. And I wasn’t the only one. During the conference, we asked attendees to take a short Rival conversational survey and share how they felt about the insights and market research industry. Almost 50% of attendees said they felt excitement today—a feeling that was certainly palpable at the conference!

My favorite part was connecting with smart people and watching brilliant sessions from insight pros like Sekisui House’s Jason Jacobson and John Deere’s Bryan Dorsey. Here are 4 key themes that stood out to me from event.

Jason had two sessions during the conference. One of them, Navigating the Great Respondent Revolt, is an offshoot of a webinar that we hosted with Jason earlier this year

At the start of his presentation, Jason asked the market researchers and CX pros in attendance this question: “Who here never answers surveys?” About 90% of the people in the room raised their hands.

“If you don’t answer surveys, how do you expect your customers to do so?” Jason pointed out. “The participant experience is broken, and it should not be. It’s an extension of your brand.”

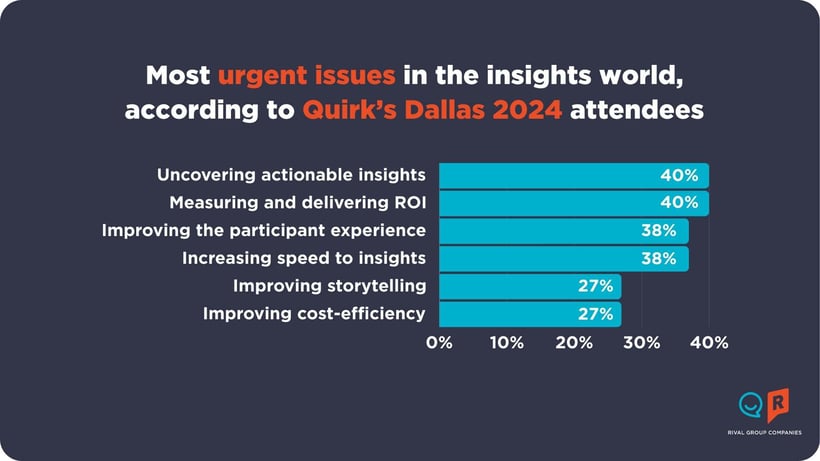

Jason’s point was validated by the conversational survey we ran during the conference: 38% of attendees admitted that the participant experience is an urgent challenge today.

So, what’s the solution? Jason proposed a more human approach — a conversational one. Do you ask your friends and colleagues the same questions every time you see them? Or, as time passes, do you remember what you already know about them and evolve your questions, getting deeper and building a two-way, long-lasting relationship? Jason's point is that the latter approach is what most humans do — so why not adopt it for research?

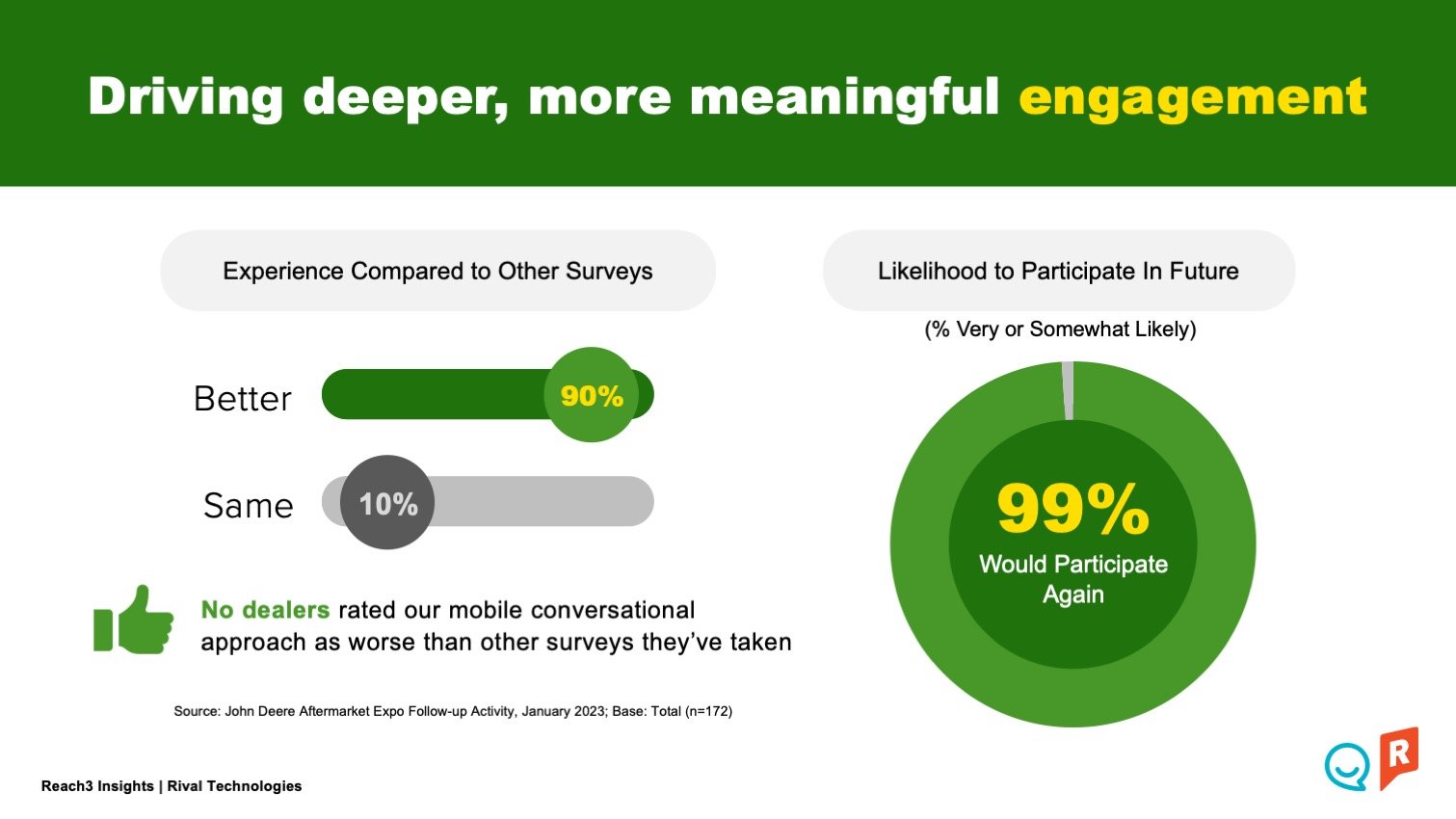

Embracing a conversational approach to research yields real business results. In Bryan’s presentation about John Deere’s insight communities, he shared that a great majority of community members preferred conversational research — which means they are more likely to continue to participate and share their authentic feedback over time.

During one of his sessions, Jason challenged attendees to “discuss with your stakeholders what the most critical business questions you need answers for to drive the biggest impact."

It’s a smart advice because to get market research ROI, insight teams need to start with business goals in mind before thinking about methodologies and survey techniques. An understanding of the business goals is critical to delivering actionable insights that stakeholders will use.

Of course, data quality is critical to delivering those insights. Unfortunately, traditional boring surveys are not the answer. Participants are not robots (even ChatGPT expects you to interact with it conversationally, hint!). If we want people to give us high-quality feedback — that is, if we want them to be thoughtful in their responses — then we need to provide an enjoyable research experience. It's all about mutual exchange of value!

Traditional surveys do not allow participants to share their real emotions and feelings or contextualize the reasoning behind a simple rating. Acknowledging their answers and using what Jason calls a “modular conversational approach” facilitates more authenticity and depth.

Clear goals and expected outcome + authentic and deeper insights are a perfect formula to getting actionable insights that will drive business impact and ROI — the two most critical challenges today, according to Quirk’s Dallas attendees who took part in our conversational chat survey.

- Bryan Dorsey, Manager of Global Research, John Deere

About 38% of researchers who took our survey indicated that getting insights faster is an urgent issue for them. Indeed, both Jason's and Bryan’s presentations spoke to this need for speed to insights.

Jason shared that on average, people receive 121 emails a day. If you’re relying on email alone to engage your customers, it would be pretty hard to cut through the clutter. I would not bet solely on email. Bryan shared that through their insight community on the Rival platform, it’s not unusual to get 40% of responses back within the first hour via SMS.

Bryan also revealed that using the conversational, mobile-first approach has allowed his team at John Deere to reach farmers in the moments that matter, gather in-the-moment insights, and capture video feedback responses in addition to all the other question types researchers are used to leveraging today.

“It was a ground-breaking way of conveying insights to internal stakeholders and C-suit to take actions that have been allowing John Deere to become a tech business while growing its business,” said Bryan.

The exhibitor hall at Quirk’s Dallas is busy — I cannot imagine how difficult it is for insight pros to decide which research partners to choose. This is especially true in times of smaller budgets and increased pressure to drive and measure the impact of the insight teams in the organization. (Well... actually, as a CMO, I think I can relate to this.😅)

During her session, Tanya Pinto, Principal Product Planner at Microsoft, touched on the importance of consistency and openness in the buyer-supplier relationship. I could not agree more.

When engaging with market research partners, client-side researchers expect consistency from every interaction, from every person from the partner organization, and from every deliverable they get. Tanya called the second one something different, but I am calling it the need to stay open. Openness to new ideas and partnerships. Innovation is essential to remain relevant, and we must constantly look for new ways to do our jobs and find the best ones. If your partner cannot give you that, you should look for new research partners who can.

That said, Jason made a good point about the importance of healthy conflict as well when engaging with research suppliers. The right partner should challenge you and bring a different perspective. It’s something that I personally believe in as well, and something we advocate for at Rival Tech and Reach3: to challenge the status quo.

It’s always invigorating talking directly to researchers and insight pros at conferences like Quirk’s Dallas. A huge thanks to everyone who dropped by our booth, took our conversational survey, and entered our contest.

From the conference, I got the sense that research teams are ready to take the industry to the next phase. And while the market research trends keep changing (hello AI!) and the challenges facing us can sometimes feel overwhelming, we have smart people working on practical solutions to reimagining research. It’s a great time to be in this industry, and I am personally excited to see what’s next.

We'd love to continue the conversation. Wondering what comes to mind for insight pros when they hear Research Reimagined? Check out this page to read and watch their ideas.

Subscribe to our blog to receive new insights on market research trends.

No Comments Yet

Let us know what you think