Insight professionals today are navigating a landscape defined by speed, complexity, and elevated expectations. To keep pace, they need research tools that are fast, flexible, and deeply connected to how people live their lives—on their phones. Choosing the right mobile survey software is a game changer for today’s insight teams who want to move fast, stay agile and deliver real business results

If your research still leans on legacy survey software, you're likely missing key voices and moments. Traditional systems struggle to engage modern consumers, particularly when feedback is needed in real time. Mobile survey and insight platforms offer a smarter path forward, helping brands stay relevant and responsive by meeting audiences where they are.

GRIT report confirms it; mobile surveys are among the fastest-growing technologies in the research world. In 2023, 90% of adults owned smartphones . In the U.S., mobile has officially overtaken desktop as the dominant mode of participation. For younger generations like Gen Z, mobile isn’t just preferred, it’s expected. But not all mobile survey tools are created equal. To choose a solution that supports modern, agile research , there are five essential questions every insight pro should be asking. But first, what is mobile survey software? But first, what is mobile survey software?

Mobile survey software refers to digital tools purpose-built for creating and collecting feedback through smartphones and tablets. These market research platforms go beyond simply resizing desktop forms. They’re designed from the ground up to deliver smooth, engaging experiences within native mobile environments.

With mobile survey software, you can deploy surveys across SMS, social media, QR codes, and embedded web formats. Interfaces often mimic the conversational style of messaging apps, making it easier for participants to respond honestly and in real time. Real-time data collection also gives researchers the ability to make decisions faster, often within hours of fielding. Faster insights mean faster results.

With mobile phones now at the heart of how we connect and consume, mobile-ready research tools are a must. If you’re not meeting people where they are, you might be missing the voices that matter most.

Traditional, email-based surveys and web forms simply don’t keep up with the pace or preferences of today’s consumers. Completion rates are lower, drop-off rates are higher, and the data often arrives too late to make a difference. In contrast, mobile surveys align closely with how people already engage with the world, resulting in fresher, more accurate customer insights.

Mobile surveys offer three clear advantages: they reach respondents instantly, gather input in the moment, and deliver faster turnarounds. Notifications through SMS or social platforms are more likely to be seen and acted on quickly. And because people respond closer to the experience like a product purchase or a live event, the feedback tends to be more specific, emotional, and useful.

The result isn’t just better data. It’s smarter, more human research.

When selecting a mobile survey platform, the key is to find one that align with how consumers behave today, not five years ago. The best insight platforms don’t just adapt to mobile—they’re built around it.

Look for:

• Seamless, app-free participation that doesn’t require downloads

• A user interface designed specifically for mobile navigation and readability

• Strong compliance support, including double opt-in and SMS verification

• Native video capture capabilities for richer, more emotional feedback

• Real-time dashboards that surface insights as they come in

You’ll also want flexibility in distribution. The ability to reach people across SMS, Instagram, Facebook, or in-app messages is critical. Anything that limits your reach — or requires third-party integrations to function — should raise a red flag.

In a world where people use the same five apps for nearly 90% of their screen time, adding another one just to complete a survey is a big ask. Even when people do download something new, the average uninstall time is under six days.

If a mobile survey platform requires an app, it's likely to limit your audience and reduce engagement. Worse, it may attract "professional survey takers" instead of genuine customers.

Rival’s mobile-first solution eliminates this problem. We reach participants directly through the channels they already use, like Instagram Stories, SMS, and TikTok . No downloads, no friction.

Data privacy isn’t a feature. It’s a requirement. Any serious mobile survey platform should offer built-in compliance tools for regulations like GDPR. This includes secure opt-in flows, consent management, and message verification.

With Rival, participants double opt-in to join insight communities. Study invites are sent through verified SMS, and every message follows compliance best practices. We’ve built these protections into our system, so you don’t have to worry about scripting or workarounds.

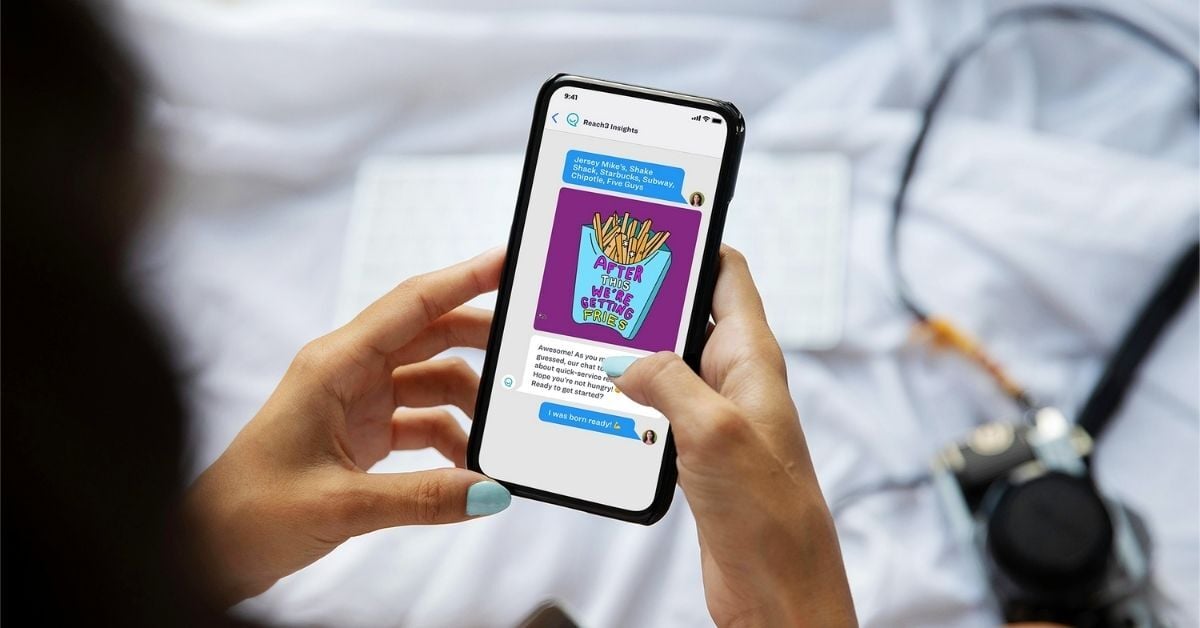

Some market research platforms claim to be mobile-ready but are essentially just desktop surveys shrunk down to fit smaller screens. These repackaged interfaces tend to be clunky, hard to navigate, and often lead to lower engagement..png?width=375&height=227&name=ReContact%20(1).png) A mobile-first platform is designed from the start for the mobile experience. Rival’s chat-based interface mirrors the way people communicate in real life. Professors at Wharton University found that respondents tend to be more self-disclosing when using mobile phones compared to computers. This conversational approach encourages more authentic feedback and dives deeper into personal experiences.

A mobile-first platform is designed from the start for the mobile experience. Rival’s chat-based interface mirrors the way people communicate in real life. Professors at Wharton University found that respondents tend to be more self-disclosing when using mobile phones compared to computers. This conversational approach encourages more authentic feedback and dives deeper into personal experiences.

Video feedback brings depth to data. Facial expressions, tone of voice, and emotion can reveal more than written answers ever could. Also, videos can enhance storytelling, capturing the attention of your stakeholders and decision-makers and increasing the ROI of your research.

Unfortunately, many market research and survey tools today still rely on third-party integrations to capture video, adding friction and complexity.

Rival’s platform includes built-in video capture, allowing participants to record responses directly within the conversational survey.

No extra steps, no external tools — just richer, more authentic insights.

Speed matters. The longer you wait to collect feedback, the more context and accuracy you lose. Mobile survey platforms that support real-time engagement, especially through push notifications and SMS, let you capture feedback right after a purchase, an event, or a key moment.

With Rival, you can send invites and start collecting responses in minutes. Get reliable insights that reflect what people are really thinking quickly and efficiently.

Choosing the right mobile survey software isn’t just a technical decision, it’s a strategic one. The best insights platforms don’t just make research more efficient; they make it more human. They help you capture authentic voices, at scale, in ways that align with how people already live and communicate.

If you're rethinking your mobile research strategy, now is the time to go beyond generic tools. Look for a platform that delivers speed, flexibility, and compliance — without sacrificing the quality of your insights.

Want to see how Rival can support your goals? Get in touch with our team to explore what mobile-first research can do for you.

Subscribe to our blog to receive the latest news, trends and best practices from market research experts.

No Comments Yet

Let us know what you think