The times, they are a-changin’, and much of what used to be ‘best practice’ is quickly becoming outdated. Case in point: online panel providers in the market research industry.

Many of the approaches that top panel suppliers have championed in the past two decades are now creating friction for community members, harming the respondent experience, and creating more work for researchers.

To get more out of online panel providers, we have to recalibrate what we want from these market research vendors—and consider the entire experience from the point of view of community members.

An online panel provider is a company or a market research vendor that manages and supplies access to a group of people who have agreed to participate in surveys, market research, or other types of online studies.

These individuals, often referred to as panelists or research participants, form a research panel that can be tapped into by businesses, researchers, or organizations looking to get insights, opinions, or data on various topics.

Before we talk about outdated practices in panel research, it’s worth discussing the relevance of research panels today.

A market research panel (or an insight community or research community) is a group of pre-screened and pre-profiled consumers who have agreed to participate in ongoing online research. Many brands that have a more mature market research function have a proprietary panel as it allows them to get real-time and longitudinal quant and qual data.

Not just a passing market research trend, communities and panels are still very popular—and relevant—in insights. For example, a recent GreenBook Research Industry Trends (GRIT) report found that more than 60% of research buyers and suppliers still use communities.

With the death of third-party cookies, panels can be a reliable source for first-party data. So, yes, they are still very relevant.

That said, the practices of the online panel provider that you're working with need to align with how people live their digital lives. The technology and techniques enabled by your panel supplier need to sync up with the behaviors and expectations of mobile-first consumers.

When selecting from top online panel providers, it's important to consider their practices, especially when it comes to how they engage participants. In particular, you should look out for old-school tactics that made sense 20 years ago but have become outdated due to shifting consumer behaviors.

These four red flags need to be considered.

1. They want you to launch a portal or a member hub

In the past, the "best practice" in online panels was to launch portals where participants could log in and see survey results, check out new activities available to them, and maybe get to know other members.

These “member hubs” take time and money to build… and, if we’re being honest, they tend to under-deliver what most online panel providers promise.

There are a few reasons why members hub and portals have outlived their usefulness:

Let’s make one thing clear: fostering engagement in your insight community or online panel is more important than ever. You need to create a mutual exchange of value if you want members to stick around and continue to provide candid feedback through your online panel provider. But portals are no longer the best way to do this.

Today, a lot of content you’d normally house in a portal can be shared easily and seamlessly through various activities that you send community members. For example, if you want to share who won a sweepstake draw, there’s no need to send people to a portal. Just add it at the top of your next conversational survey before asking your next questions.

If the online panel provider or software that you’re using doesn’t facilitate this type of in-survey engagement, it’s time to consider other options.

As a researcher, not having a portal also frees up your time (and budget!) so you can focus on what matters most: creating engaging research studies and generating insights that drive strategy forward.

2. They recommend sending email newsletters

Emails are the bane of many people’s existence—and researchers and participants are no exception.

Thanks to clogged inboxes, email can be a big drain on time and resources. And let’s face it, emails often go unopened. So why do so many online panel providers insist on sticking to email only for survey distribution?

In the past, research panel suppliers championed the use of email newsletters to enable sharebacks and show members how their insights were influencing decisions on product, marketing, and customer experience. Emails were also used to provide sneak peeks, give special access, and send out incentives.

When they were introduced, email newsletters played a key role in driving engagement in many online market panels because email was less cluttered and an effective way of reaching people. That's no longer true today. Many of the things newsletters are supposed to facilitate—sharebacks, sneak peeks, incentives, and more—can be shared in a far more interesting and easier way.

Again, the key here is to incorporate these elements more seamlessly into your next activities for your online panel. Rather than sending a standalone email to your members, add those content pieces in your conversational surveys.

Videos, in particular, can be a powerful motivator especially if you’re engaging with Gen Z & Millennial audiences. Take for example, Ciara and Russell William’s new brand, The House of LR & C. To engage their insight community, they regularly incorporate video from Ciara and Ruseell into their surveys, thanking people for participating.

The good news: you don’t necessarily need a celebrity to make video sharebacks work for you. Rival customers like Dell Technologies feature their employees in their videos—and the results are just as compelling. Community members simply like to know there are real people behind your research—it’s as simple as that!

If you're talking to an online panel provider and their pricing includes charging per survey complete, that's a huge red flag. Not only does this drive up your market research costs, this pricing model also means you’d have to be more strict about quotas and quickly disqualify potential members.

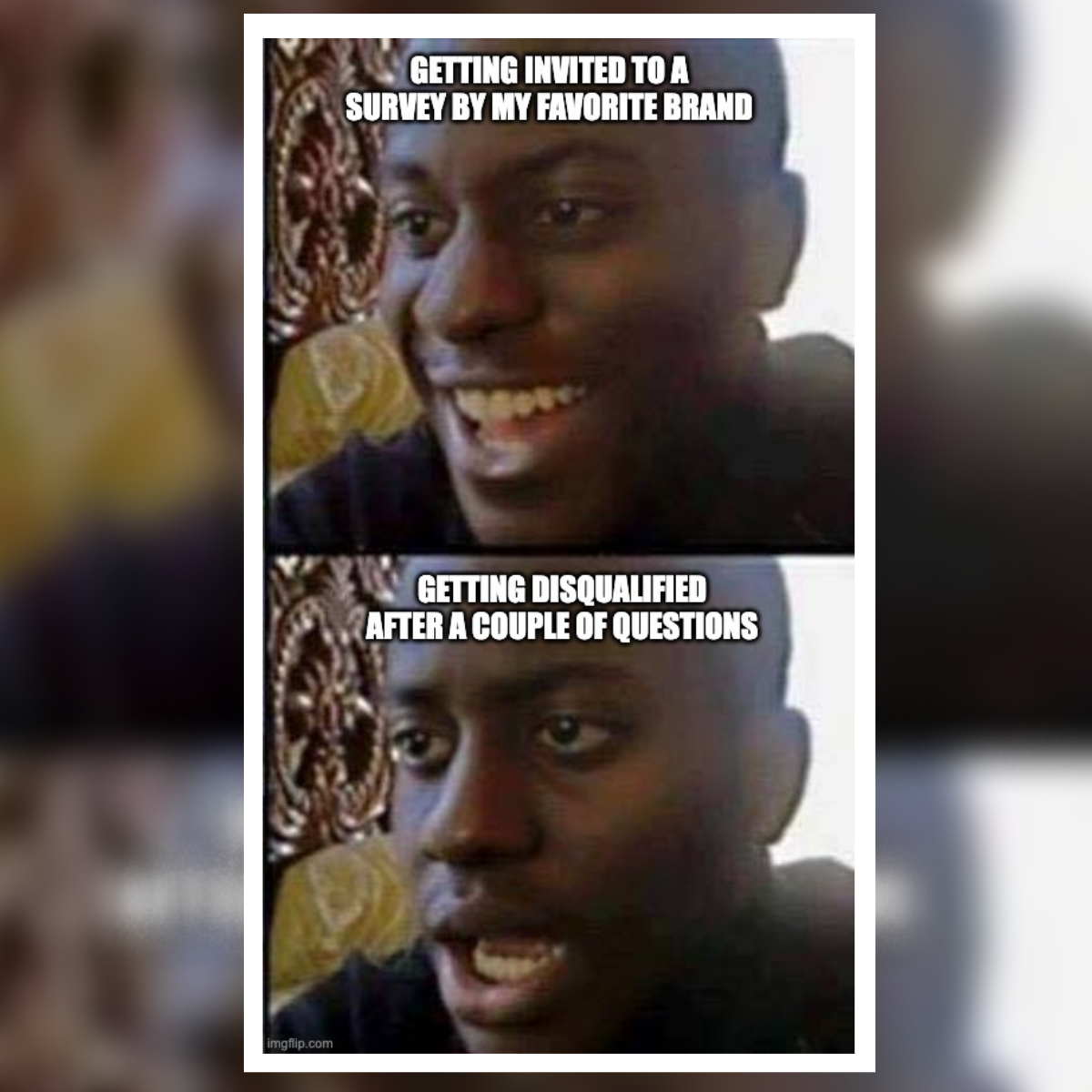

You might be thinking, “Big deal. Disqualifications are a natural part of the process.”

To address this, I’d challenge you to think of the experience from the consumer’s point of view. You invite them to a panel survey, offering the potential to share their ongoing feedback with you, and then—BAM!—they are disqualified after just a few questions.

No one wants to be rejected—especially when they’re talking to their favorite brand.

Whether you like it or not, the survey and market research experience is part of the brand experience today. That's why regardless of the online panel provider you're working with, you have to be thoughtful about how you disqualify potential research participants. People’s experience with your surveys can have a long-term impact on how they view your brand.

This is why, as an insight community platform and online panel provider, we don’t believe in charging per complete. It’s also why we’ve invested in a customer success team whose mandate is to help you deliver the best respondent experience and maximize the utility of your community.

Ultimately, when you say goodbye to "per complete pricing," you can shift your focus to the respondent experience and prioritize creating a more meaningful interaction—even if the person on the other side isn’t quite who you’re looking to recruit to your insight community.

Similar to not making members sign into a portal, you want to keep making it as frictionless as possible to join and participate in your research panel or community. That means not requiring your members to download yet another app on their phone.

There’s a few reasons you should rule out an insight community app or mobile survey app altogether:

The best online panel providers today don’t require an app—rather, they enable you to meet your members where they are. Once people are recruited in your community, you can easily notify them of new activities via SMS, for example, and share a link that opens seamlessly through their default browser on their phone. Easy and simple!

Portals, newsletters, fixed completes, and apps all had their time when they made sense. But times have changed. Your audience is living in a mobile-first, on-the-go, interactive world, and their expectation is that you keep up.

By choosing a panel supplier that prioritizes participant experience, you’re more likely to maintain high engagement in your community and get the ROI you’re looking for from this type of research.

To learn more about our approach to mobile-first research, visit our Community 2.0 page or watch our webinar "Insight Communities: How to 10x your Impact with Mobile-First Approaches."

No Comments Yet

Let us know what you think