.webp?width=1200&name=SpikeTrap%20Artificial%20Intelligence%20Banner%20v2%20(1).webp)

Rival Technologies partnered with Spiketrap, the leader in contextual AI, to solve one of the biggest challenges in the consumer insights space—making sense of unstructured data— without wasting money, time, and human resources.

The largest transfer of wealth in US history is taking place. As Baby Boomers have begun transferring their assets to the younger generations, close to $70 trillion USD has been set in motion. This huge transition highlights the need for financial institutions to dedicate more resources towards understanding the banking attitudes, habits and preferences of these groups.

.webp?width=500&name=Contextual-Ad-1200x760%20(2).webp)

Rival Technologies partnered with MX, Finn AI and Q2 to conduct a study on the financial well-being of Gen Xers, Millennials, and Gen Zs. The primary objective of this study was to understand how these age groups are interacting with their banks or credit unions, including preferences for communicating with contact centers, digital engagement, and needs for financial literacy. A report was produced by MX, Finn AI & Rival Technologies assessing the landscape of modern-day banking.

In addition to this study, Rival Technologies harnessed the power of Spiketrap's artificial intelligence (AI) and machine learning (ML) capabilities to analyze three questions collected during this research. The purpose of this additional research was to further analyze the core themes and sentiments that emerged from the open-ended questions and to measure the efficacy of AI-based tools to automate the data analytics process.

The study had over a thousand participants across the USA, which generated over ten thousand responses. Undertaking a manual data analysis task with thousands of responses is extremely time consuming, expensive, error-prone, and hard to scope (as human input is not straight forward to determine up front). As a result, these datasets are often left unanalyzed, and if they are, it is done quite poorly and offers little insight.

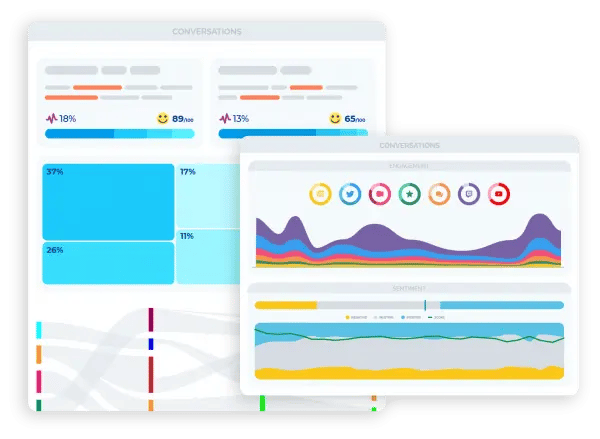

This is where Spiketrap came in. Spiketrap’s data processing capabilities allowed Rival to extrapolate core themes for all the open-ended data collected. These themes were then automatically matched with corresponding statements paired with sentiment. This automatic process produced faster, better & cheaper results than any manual effort would have returned. Additionally, the software's NLP capabilities allowed for a deeper, more robust level of sentiment analysis that is not possible when using basic Likert scales.

Overall, Spiketrap’s AI/ML solution was able to accurately analyze the open-ended responses at scale, while reducing resources needed and ultimately streamlining the data analysis process.

“The greatest opportunity for banks and credit unions is to capitalize on the level of trust they’ve already established with their customers. This includes offering competitive and valuable products and services and keeping the human touch even as interactions move into digital channels.”

-Shayli Lones, VP of Go-to-Market at MX